Whether you are starting out as an OnlyFans creator or looking for ways to maximize your revenue, there’s one important thing to consider: taxes. Yes, the government charges taxes on your OnlyFans income as well! Hence, it is essential for a creator to understand the technicalities of OnlyFans taxes to be tax compliant!

Many creators have created their million-dollar empires with OnlyFans! Since its inception in 2016, the platform has paid its creators $5 million.

You might be earning money as a primary source of income or as a side gig, but dealing with complicated tax policies could be intimidating! If you want to learn more about the OnlyFans tax, you are in the right place!

In this blog, we will explain everything you need to know about taxes as an OnlyFans creator. From the essential tax forms to how to file taxes for OnlyFans, we have covered everything in depth. So, let’s deep dive into the world of OnlyFans taxes!

Table of Contents

- 1 Do OnlyFans Models Pay Taxes?

- 2 OnlyFans Taxes: Overview

- 3 What are the forms OnlyFans Creators Must Know?

- 4 How to File Taxes as an OnlyFans Creator: Step-by-Step Guide

- 5 What are the Deductions Possible as an OnlyFans Creator?

- 6 What are the Deductions Not Possible From OnlyFans Income?

- 7 Conclusion

- 8 FAQs-Related to OnlyFans Taxes

Do OnlyFans Models Pay Taxes?

According to the IRS, every OnlyFans creator is self-employed. So, yes, you have to pay taxes regardless of whether you are a new creator or one of the top % of OnlyFans creators.

Your OnlyFans income would come from subscriptions, tips, DMs, PPVs, etc. But everything is counted as taxable income! In the U.S., you must pay self-employment taxes on your income at a flat rate of 15.3 %.

While the majority of OnlyFans creators are into adult content, they might not find their work legitimate enough to file taxes. And some might even wonder how to hide OnlyFans on taxes! But it’s your responsibility to proceed with the taxation process.

So, as a creator, you must pay self-employment tax along with the federal income tax. An important point to note here is that the platform won’t deduct the taxes for you; it’s your responsibility to pay them.

What happens if you don’t pay your taxes? Like the standard taxation guidelines, you might face fines, criminal charges, or other serious consequences if you fail to pay your taxes.

OnlyFans Taxes: Overview

With 210 million users, OnlyFans is indubitably a popular content-sharing platform. The platform is widely used in the United States of America, the United Kingdom, Canada, and Australia. Moreover, the tax rules and laws in these countries differ; hence, knowing how taxes work in your country is essential.

So, let’s get into the nitty gritty of OnlyFans taxation in these popular countries!

United States of America

In the U.S., self-employed professionals who earn a yearly income of $400 or more must report their income and file taxes. OnlyFans will issue the 1099 form to these creators during tax filing.

Do you want to be taxed as a sole proprietor or LLC? As business owners, creators have the freedom to determine how they wish to be taxed.

Another news that favors creators is that the 15.3% taxes are applicable on net business income rather than gross income. So, gauge your deductible business income to reduce your taxes.

United Kingdom

On the other hand, the threshold limit for filing taxes is £12,570 in the United Kingdom. Here, a self-employed professional must pay income tax and National Insurance Contributions(NIIC).

First, deduct your business expenses from your self-employed income and multiply it by the tax rates to find your taxes. Further, if you make more than £12,570 in profits, you must contribute Class 4 NICs.

Canada

If you are a self-employed professional in Canada, you must file self-employment taxes regardless of your income. Canada follows a progressive tax system, so the higher your income, the more tax you pay. The tax rates depend on your federal income tax bracket and the province or territory of your residence.

You must use form T2125 to report your self-employment taxes. Additionally, if you are within 18-70 years and are self-employed, you also have Canada Pension Plan (CPP) Contributions. Further, if your income exceeds $30,000 for about three to four consecutive months, you must register for a GST number and pay the GST/HST taxes as well.

Therefore, in Canada, your total tax is your income tax + CPP + GST (if applicable) — the business deductions.

Australia

Another country where OnlyFans is popular is Australia. Here, a self-employed professional is subject to income tax and Medicare levy. The income tax rates depend on the fixed tax bracket range. So, if an individual earns less than $18,200, they don’t have to pay taxes.

Additionally, the creators have to pay a 2% Medicare levy on their taxable income. A higher income also implies a higher Medicare surcharge of 1.0% to 1.5% of the taxable income. Furthermore, if their business surpasses a GST turnover of $75,000, they must register for GST taxes.

What are the forms OnlyFans Creators Must Know?

If you are a creator understanding how to do taxes for OnlyFans, consider getting acquainted with the different OnlyFans tax forms.

Listed below are the crucial OnlyFans tax forms for filing taxes:

-

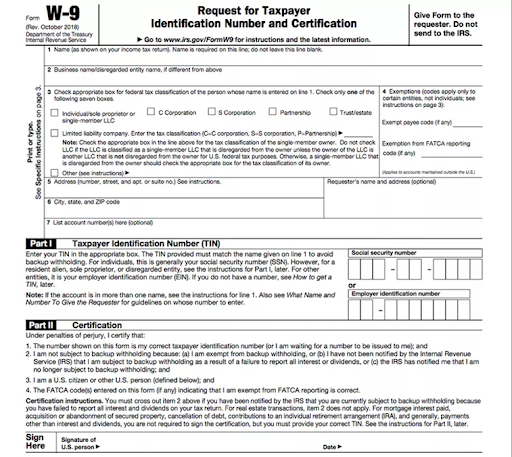

W-9 -Request for Taxpayer Identification Number and Certification

As an independent contractor working for a company, you are required to complete the W-9 form. This Internal Revenue Service(IRS) tax form provides the employer with information like name, address, and tax identification number(TIN) for employment. The details obtained from the W-9 form are often used to generate a 1099 tax form for tax filing purposes.

When you try to withdraw money from the OnlyFans account, you will be prompted to fill out the W-9 form. The form is quite straightforward and includes detailed instructions from the IRS.

-

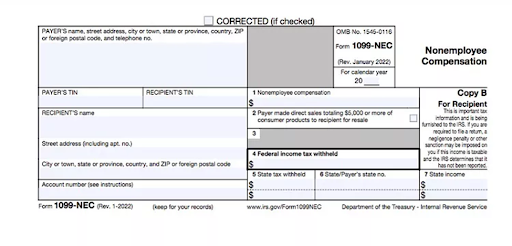

1099-NEC (Non-Employee Compensation)

The next important form is the 1099-NEC form, which OnlyFans sends if you earn $600 or more on the platform. So, the 1099 form is not like your W-9, where you fill it out; instead, it just informs you about your gross business income made through OnlyFans.

You will receive the 1099-NEC form by January 31st. However, if you are not a U.S. resident or you earn less than $600, OnlyFans won’t send you the form.

-

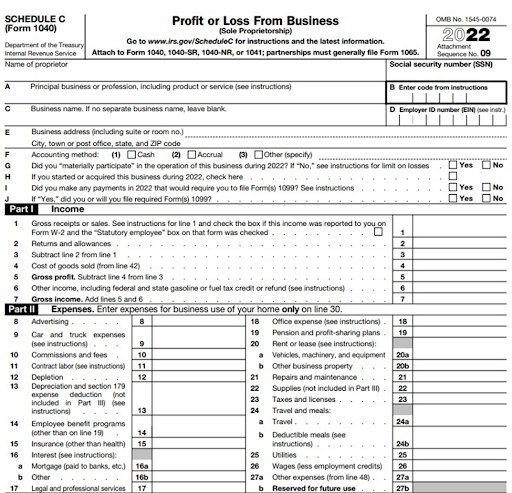

Schedule C (Form 1040) – Profit or Loss from Business

As an OnlyFans creator, you must complete Schedule C on your 1040 tax return form. This form reports the profits and losses made from your OnlyFans account. So, what are the details required to complete the form?

You have to fill in the basic details like name, address, etc. Next, you must mention the gross income earned from OnlyFans account and the business expenses incurred.

In the later section, we have discussed the different business write-offs in detail. Knowing which business expenses are considered business write-offs decreases your taxable sum.

When you deduct the expenses from your income, the amount left is your taxable sum. This is the income on which your self-employment tax is calculated!

It is essential to provide all the information accurately to avoid any miscalculations.

-

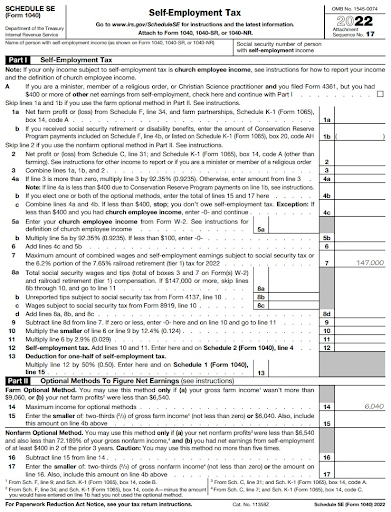

Schedule SE(Form 1040) – Self-Employment Tax

The last form you need to know is the Schedule SE (self-employment tax) form. Here, you calculate the self-employment tax you owe.

Calculate the amount you have to pay for Social Security and Medicare taxes. As mentioned earlier, the self-employment tax rate is 15.3%. To calculate the self-employment tax, you need to enter the net taxable income from Schedule C (the previous form). Follow the instructions in the form, and finally, you can determine your self-employment taxes!

Additionally, if you reside in the United Kingdom, Canada, or Australia, here are the forms you must know:

| Country | Essential Forms |

| United Kingdom | SA100 (Self- assessment tax return)

SA103S (Self-Employment Short) SA103F (Self-Employment Full) |

| Canada | T1 General (Individual Income Tax and Benefit Return)

T2125 (Statement of Business or Professional Activities) Form T4A (Statement of Pension,Retirement, Annuity, and Other Income ) Form T5013 (Partnership Information Return) GST/HST Return |

| Australia | Individual Tax Return

Business and Professional Items Schedule for Individuals (Schedule C) |

How to File Taxes as an OnlyFans Creator: Step-by-Step Guide

While you might be overwhelmed with the technicalities of OnlyFans taxes, the real deal is when you start filing your taxes. That’s where this OnlyFans tax calculator could help!

Here’s a step-by-step guide on how to file OnlyFans taxes:

Step 1: Understanding your tax obligations

As an OnlyFans creator, you are a self-employed professional. Like any other source of income, you are required to report your OnlyFans earnings to the IRS. Self-employment tax is typically collected for freelancers, independent contractors, or sole proprietors who earn from a business or trade.

It includes social security tax and medicare tax. While the social security tax rate is 12.4%, the medicare tax rate is 2.9%, which amounts to a total self-employment rate of 15.3%. If you made more than $600 in a year, you will receive a 1099 Form from OnlyFans.

Step 2: Set up an LLC

As an OnlyFans creator, you need extra privacy protection, as you are susceptible to vulnerability, data theft, and other risks. Setting a Limited Liability Company(LLC) for your OnlyFans account safeguards you against business risks. So, if a lawsuit is filed against your business, you are not personally liable for the charges.

The other benefits include separating your business and personal assets, protecting your assets from the Internet, and availing the business write-offs.

Step 3: Create a separate bank account for the OnlyFans business

Have you considered creating a separate bank account for OnlyFans? Good bookkeeping practices are essential for an efficient tax filing process.

Creating a separate bank account for your OnlyFans business helps delineate your income and expenses. It also helps track business deductions incurred and reduces overall taxable income.

Step 4: Know the essential forms for tax-filing

Knowing about the different OnlyFans tax forms is essential when filing taxes. Understanding how to get tax forms from OnlyFans helps avoid any oversights or inaccuracies.

In the U.S., W-9, 1099-NEC, Schedule C, and Schedule S.E. are the crucial forms for filing taxes. We have included a detailed section about the essential tax forms for different countries later. It is always safe to consult a tax professional to ensure you download and submit appropriate tax forms.

Step 5: Calculate your OnlyFans income

As an OnlyFans creator, you can make money from subscriptions, PPVs, tips, custom content, etc. Download your 1099-NEC form, which will inform you about your income for the year. As you know, OnlyFans only sends 1099 forms to creators who made $600 or more in that financial year. For a clear perspective on your OnlyFans income, know how the OnlyFans payout works.

Step 6: Identify the tax write-offs or the business expenses

Business expenses are the “essential” and “ordinary” expenses incurred in your business. You must mention them in Schedule C (Part 2). These expenses are deducted from the gross income to calculate the taxable sum.

Simply put, accurately documenting your expenses helps reduce your taxes. To know which business expenses can be classified as deductible, refer to the “What are the Deductions Possible as an OnlyFans Creator?” section.

Step 8: Calculate the self-employment tax

Once you know your business deductions, you must calculate your self-employment taxes. To do this, you must deduct your business expenses from your gross income.

Further, the remaining amount is multiplied by the self-employment tax rate of 15.3% to find the self-employment taxes you owe. When filing taxes, individuals must include the 1099 form received from OnlyFans. To ensure a smooth and hassle-free tax filing process, set aside an estimated amount from your OnlyFans income.

Step 9: Analyze if you will pay OnlyFans quarterly

If you earn significant money from OnlyFans, the IRS expects you to pay your taxes quarterly. Owing a tax of $1,000 or more in a year can qualify you to pay taxes quarterly. Besides, it is better to make quarterly payments than withholding taxes until the end of the year.

Here’s a quick overview of how to make quarterly payments:

| Quarter | Quarterly Payment Dates |

| 1st Quarter | April 15th |

| 2nd Quarter | June 15th |

| 3rd Quarter | September 15th |

| 4th Quarter | January 15th of next year |

Step 10: Consult a tax professional or use tax-filing software

Given the different forms and calculations involved, filing taxes is undoubtedly intimidating for a new creator. But you cannot hide your OnlyFans taxes even though you are considered a self-employed professional.

So, is there a way to make things easier? Yes, you can consult a tax professional or use tax filing software to reduce your tax burden.

Accounting software like Quickbooks Self-employed or TurboTax can automate specific bookkeeping tasks, such as determining deductible expenses. This lessens the burden of the taxation process and also increases overall accuracy and efficiency.

What are the Deductions Possible as an OnlyFans Creator?

Now, like standard taxation, you can also list the common deductions. The more tax write-offs you add, the less taxes you must pay. But how do you decide whether an expense qualifies for a deduction?

You must differentiate it as an expense for businesses or hobbyists. For example, if phone calls are an essential part of your creation process, then you can enlist them in the deductions. However, you must specify the percentage of usage, like 30% for work and 70% for personal use. So, 30% of the phone bill is counted as deductions.

Here’s a handy list that can help you classify your deductions:

- Equipment for recording, lighting, and filming like cameras, microphones, lighting, smartphones

- Software for content creation, such as Adobe Lightroom, Facetune, PicsArt, etc.

- WiFi and internet usage for your OnlyFans business(specify the percentage of usage)

- Percentage of rent space utilized for OnlyFans content creation

- Travel and lodging costs incurred for shooting at a specific location

- Advertising and marketing costs for promoting your OnlyFans account

- Costumes, props or decorative items for cosplay, etc.

- OnlyFans commission and transaction fees are charged.

The expenses must be both ordinary and necessary to count as a deduction. Here’s a link to the IRS guidelines for business expense resources.

What are the Deductions Not Possible From OnlyFans Income?

As a creator, you cannot write off any expenses that can be used for personal purposes. For example, consider cosmetic implants. Although these expenses have been incurred to enhance your content creation process, they also enhance your looks in your personal life.

Here’s a comprehensive list of non-deductible expenses:

- Hair removal services

- Haircut and styling

- Beauty and Makeup

- Tanning services

- Clothing

- Nail care

- Supplements

- Botox and lip liners

- Facials

- Tattoos

- Health and fitness services like gym membership or personal trainers

Conclusion

Whether you are a self-employed professional or work a regular 9-5 job, taxes are often a dreaded topic. However, being an OnlyFans creator exempts you from filing your taxes. After reading this blog, you will have a clear idea of how OnlyFans tax works. This blog lists the essential forms for filing taxes and provides a step-by-step guide to completing the taxation.

The self-employment tax rate depends on your country and province of residency. Moreover, the golden figure you owe as taxes depends on your OnlyFans income, deductible business expenses, and tax rates. Seek help from a tax expert for a smooth tax filing process. Lastly, file taxes accurately and on time to continue your content creation journey!

FAQs-Related to OnlyFans Taxes

1. Does OnlyFans Pay taxes?

As a creator, you earn income on OnlyFans through subscriptions, tips, DMs, and PPVs. So, you are a self-employed professional who must report your taxes to the IRS.

2. What are the tax guidelines to follow as an OnlyFans creator?

Claiming the business expenses, setting up an LLC, and maintaining a separate bank account for OnlyFans expenses are a few tax guidelines that creators can follow.

3. Is OnlyFans considered a job?

The money you earn through OnlyFans is subject to taxes as a regular 9-5 job. In fact, if you are a creator at OnlyFans, you are considered a self-employed professional.