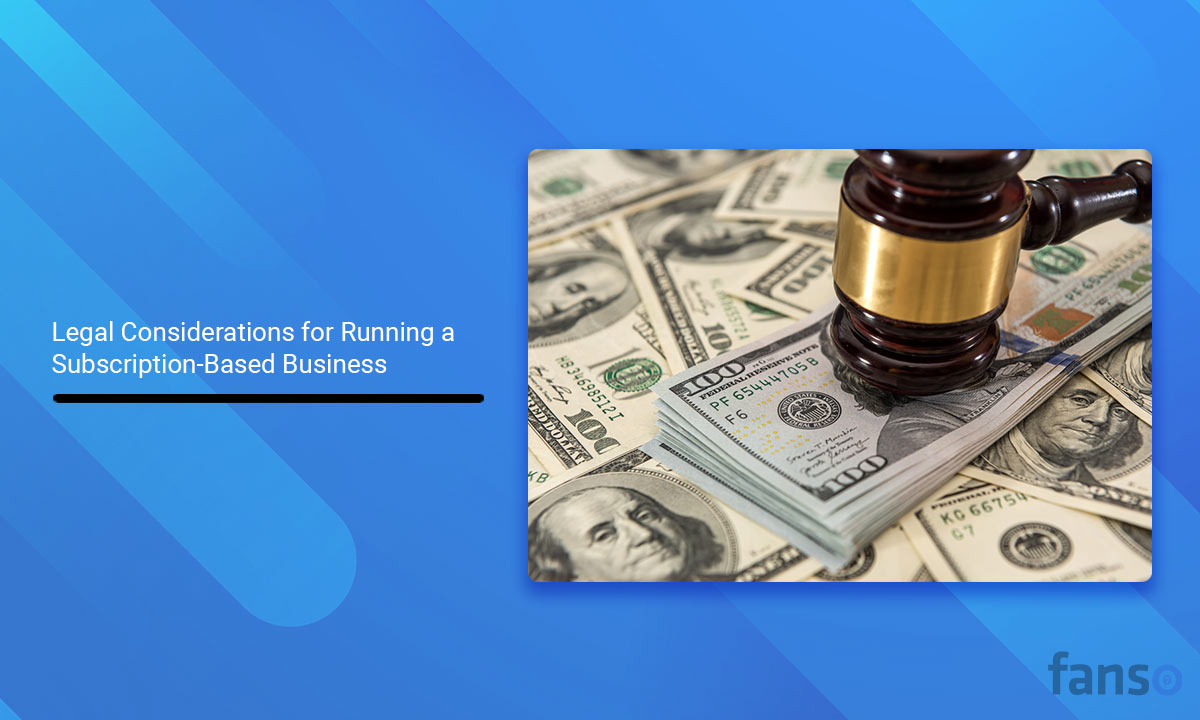

Starting a subscription business definitely offers a steady income and drives customer retention. While more businesses are adopting the subscription model, there are a slew of laws to ensure compliance.

Navigating the legalities could be challenging, as there is no single governing “subscription law.” Regulations and procedures differ across countries and states, as well as with subscription services and delivery methods. Let’s explore the key legal considerations for subscription-based business and effective consumer management practices.

Here’s what you’ll learn in this blog:

- Choosing the right business structure

- Regulatory Compliance & Consumer Protection Laws

- Payment Processing and Recurring Billing Compliance

- Contracts, Terms of Service, and Privacy Policy

- Data Privacy & Cybersecurity Regulations

- Handling Cancellations, Refunds and Customer Disputes

- Cross-Border Tax Implications

So, it’s time you revamp your website’s terms and conditions, privacy and refund policy!

Table of Contents

- 1 1. Choosing the Right Business Structure

- 2 2. Regulatory Compliance & Consumer Protection Laws

- 3 3. Payment Processing and Recurring Billing Compliance

- 4 5. Data Privacy and Cybersecurity Regulations

- 5 6. Handling Cancellations, Refunds, and Customer Disputes

- 6 7. International Expansion: Cross-Border Tax Implications

- 7 Conclusion & Legal Best Practices

- 8 FAQ-Related to Legal Considerations for Subscription Business

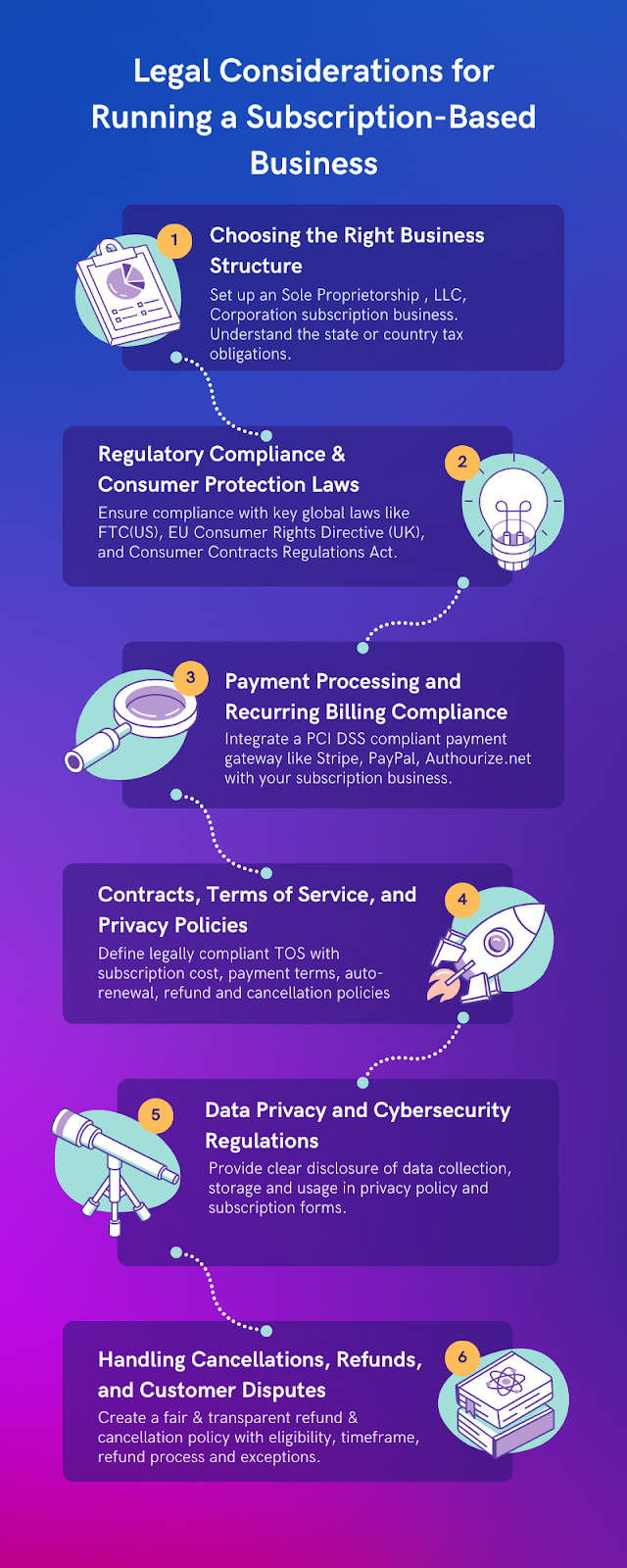

1. Choosing the Right Business Structure

Setting up your business structure is one of the most essential steps to start your subscription-based business. Now, this affects several aspects of running your business — registration, profits, legal maintenance, liability, taxes, etc. Besides it also affects your normal business operations like the ownership of your business, and your personal assets at risk.

Sole Proprietorship vs. LLC vs. Corporation

The most common business structures for subscription businesses are sole proprietorship, LLC, and Corporation. Here are the advantages and disadvantages of each business type:

Sole Proprietorship

This is the simplest business structure run by a single person. Many independent entrepreneurs start their business as a sole proprietorship and it’s the least expensive structure to start.

Here there are no set barriers for personal and business income. The business income taxation comes under personal tax returns. However, in dire consequences, there’s no liability protection given to the owner’s personal assets.

Pros

- Offers ease of setup as there are no partners involved and you have to deal with less paperwork

- Less expensive as license fees and business taxes are the only costs involved

- Flexible for those running the businesses along with a full-time job

Cons

- No liability protection for your personal assets if the business incurs financial loss

- Less credible for investors and makes it difficult to raise capital

LLC

A limited liability Company(LLC) is a hybrid business structure offering the best of both corporation and partnership structure types. It combines partnership’s tax benefits (taxed as a single entity) with the corporation’s limited liability advantage. Small business owners generally choose to create an LLC, given its simplicity and liability protection.

Pros

- Offers liability protection for your personal assets

- Single-owner LLCs are not considered separate entities for taxation

- Less paperwork as compared to C and S corporations

Cons

- Pay self-employment taxes on your earnings

- Difficult to raise capital; investors prefer corporations

Corporations

Corporations are the most complicated legal structures, requiring more capital and complex paperwork. Like LLCs, shareholders of corporations have limited liability (they are not personally liable for business claims). C corporations and S corporations are the most popular corporation types.

Pros

- Corporations and owners are separate entities and stakeholders not liable for business loss

- Easier and credible enough to raise large amounts of capital

- Continuity of normal operations, even if someone departs or sells shares

Cons

- Complex and expensive structure and involves more legal compliances and paperwork.

- C Corps might be subjected to double taxation

- Subject to extensive record-keeping and audit procedures; requires annual and shareholder meetings

Tax Implications of a Subscription Model

The taxation for subscription services differs from traditional one-time purchases. It’s one of the important legal considerations for running a subscription business.

Understanding Recurring Revenue Taxation

Understanding the tax obligations of subscription businesses could be challenging, considering its recurring revenue. Recurring revenue is a company’s revenue that is expected to continue in future. Auto-renewal subscriptions are counted as recurring revenue; they continue until the consumer terminates the service. Managing the recurring billing and payment gets increasingly complex, as the audience base grows.

Sales Tax Requirements for Digital vs. Physical Subscriptions

The sales tax might not be the same for all subscription services. The taxation differs based on state and tax regulations. Moreover, subscriptions might be billed based on origin or destination of services.

Some states might consider subscription services taxable, while in other states, they are exempt. Taxation also differs based on billing frequency: monthly, annual, or semi-annual.

Further, knowing which products are taxable is another aspect businesses need to consider. Some consider digital products as tangible products, treating them as physical goods. So, the definition of tangible products is broad in these states.

Other states might consider digital download as a service. So, the digital services might be subjected to taxes only if the specific state imposes tax.

Further, tax obligations might be dependent on sales presence or nexus (physical presence). For instance, businesses meeting a specific sales threshold or nexus presence might be required to remit sales tax. For example, digital products are taxable in Arizona but not in California.

Lastly, subscription laws change from time to time, so update yourself regularly.

2. Regulatory Compliance & Consumer Protection Laws

When starting your subscription business, compliance with global laws is paramount. These laws typically deal with different aspects of the subscription economy: consumer protection, easy cancellation, tracking dark patterns and clear disclosure of information.

Key Global Laws Affecting Subscription Businesses

Federal Trade Commission (FTC)

The Federal Trade Commission (FTC) is the US’s consumer protection agency. It enforces different policies for transparent and fair practices for content creators.

“ The FTC Act empowers the agency to investigate and prevent deceptive or unfair methods of competition in commerce. This protects consumers and promotes positive competition.”

The FTC has stringent regulations for endorsements, testimonials and influencer marketing.

Here’s what FTC’s areas of concern are for subscription services:

- Clear disclosure of information: Subscription businesses should provide clear information about their subscriptions before the customer makes the purchase.

- Easy cancellations: Cancelling subscriptions hasn’t always been as easy as signing up. The FTC’s recent click-to-cancel rule supports a simpler cancellation process, keeping aside endless hoops and traps. The rule also prohibits negative marketing for goods and services. Besides, the FTC emphasizes disclosing essential information and getting consumers’ consent before serving them additional offers.

- Dark patterns: The FTC is serious about cracking down on the “dark side” of a subscription business. Unexpected flash sales, limited-time countdown clocks, and hidden purchase fees are some of the dark patterns it has spotted.

EU Consumer Rights Directive (UK)

The EU consumer rights directive protects consumer rights across the European Union. Like the FTC’s cancel-to-rule, the directive aims to harmonize consumer protection rules. It lays down the information traders need to provide before a consumer purchases digital goods, services, or digital content.

It also bans pre-ticked boxes and charges additional payment fees in addition to the trader’s main contract.

Consumer Contracts Regulations 2013 & DMCC Act (UK)

If you own a subscription business in the UK, your services must align with the Consumer Contracts Regulations Act. The act lays out the information to be shared by the trader with consumers, consumer rights to change decisions and return the goods or service, exception rules for distance selling.

There’s a “cooling off period” of 14 days after one purchases the product or service. The customer can change their mind and return the product, expecting a full refund within this period.

The Digital Markets, Competition, and Consumers Act 2024 (DMCC) is another act that has created ripples in the UK’s subscription landscape. It was introduced to amend the existing Competition Act 1998 and Enterprise Act 2002.

It aims to introduce provisions for fair competition practices and protect consumer rights. This way the act protects consumers from falling into “subscription traps”. Businesses need to provide pre-contract information,cooling-off period, reminder notices, and easy cancellations.

Consult a lawyer to get legal advice and be acquainted with recent advancements in the legal landscape.

Auto-Renewal & Cancellation Policies

Customer retention is the norm for subscription services, and so is the annoying auto-renewal feature! With every other subscription you activate, managing them feels like being stuck in a maze!

To the point that you even forget to cancel subscriptions you are no longer using and feel frustrated for every $100s or $50s that gets cut unknowingly. Thus, you’re stuck in a subscription trap!

While the business owners haven’t defied the law, it doesn’t eliminate customers’ disappointment. But, active opt-ins and renewal reminders could save the day!

In addition to the FTC’s regulations, California’s Automatic Renewal Law (ARL) is a state-level preemptive measure to regulate subscription billing. Under the law, businesses must send an acknowledgement with a clear disclosure of the terms and conditions and cancellation policy before the user subscribes.

3. Payment Processing and Recurring Billing Compliance

The recurring payments provide automated cash flow, but you also deal with failed transactions and chargebacks. Businesses need to integrate robust payment processing systems that streamline payment processing and also security.

Secure Payment Handling: PCI DSS Compliance

Subscription businesses need to deal with managing sensitive customer information like credit card information and offer transaction security. A payment gateway that’s compliant with Payment Card Industry Data Security Standards (PCI DSS) handles these transactions securely.

So, what’s PCI DSS compliance?

This simply means adhering to a standard set of security rules to protect cardholder data. All entities, including merchants, payment gateways, banks, and service providers, follow the rules. This reduces the risk of data breaches and offers fraud prevention.

Stripe, PayPal, and Authorize.net are a few popular PCI-DSS-compliant payment gateways.

Here are the basic steps involved in recurring payment processing:

- Customer authorization – During the checkout process, the customer gives consent for recurring payments and provides the credit card or bank information.

- Secure storage of payment information – The customer payments are tokenized and stored for future transactions.

- Processing payments at scheduled intervals – Whether businesses opt for weekly, bi-weekly, or monthly payments, the payment gateway processes the payment accordingly.

- Transaction request and confirmation—The payment gateway initiates a payment request to the bank or credit card authorities. Then, the customer is notified of the successful transaction.

Additionally, upgrades, downsells, cancellations, and refunds are included in subscription management.

4. Chargeback Management & Fraud Prevention

As global e-commerce revenue increases, fraudulent chargeback incidents significantly increase. Digital Trust Index reported an alarming 78% year-over-year surge in chargebacks, and Q1 2024 was called the “chargeback season.”

So, what’s a chargeback? Consumers can initiate a chargeback and seek a refund in the event of fraud, product or service dissatisfaction, or merchant errors. While chargebacks are a consumer protection mechanism, consumers often use them to their advantage and raise illegitimate chargeback requests.

Frequent chargeback requests can eat up your subscription business’s profits. On top of that, high-risk merchants are more vulnerable to chargebacks.

Given are the top fraud back prevention strategies:

- To reduce customer disputes, implement transparent terms and service, including subscription cost, customer billing, refunds and returns policy.

- Provide excellent customer service and record order delivery and status for accurate information

- Integrate identity verification protocols like biometric verification, two-factor authentication, and security questions

- Use fraudulent detection tools like AVS, CVV(3-digit verification number behind credit card), 3D secure, etc.

- Deal with chargebacks effectively with automated chargeback notifications and responsive services, documentation services, and appropriate escalations.Contracts, Terms of Service, and Privacy Policies

When starting your subscription business, defining contractual obligations and terms of service is non-negotiable. Regular and effective communication reduces customer disputes and facilitates effective resolution.

Crafting a Legally Binding Terms of Service (TOS)

A term of service establishes the grounds of sound agreement between consumers and business owners.

The subscription agreement must include the following details:

- Rights & responsibilities when using the subscription

- Payment terms & subscription cost

- Auto-Renewal clauses

- Cancellation & refund policies

- Confidentiality & non-disclosure agreements on how you handle their data

- Licensing details & the restrictions of usage

- Systems to manage declined payment & egregious actors

- Limitation of liability explaining the provider’s liability from the damage due to subscription services

Privacy Policy Compliance

Subscriptions often manage and store consumers’ personal information. A privacy policy is important to explain the personal information you collect, how and why you collect data, the security measures employed, and customer privacy rights.

Why do you need a privacy policy for subscription business? Many state and global data protection laws like GDPR and CCPA expect subscription businesses to maintain privacy policy.

To comply with these laws, businesses must obtain consumer consent before collecting and processing data. They must implement security measures and comply with cross-border data transfer restrictions.

Intellectual Property Protection

When you find a niche idea and set up your subscription business, you typically brainstorm a business name and seek the right investors. But there’s one more essential thing — protect your business’s intellectual property (IP)

IP is basically anything you create and put in the public domain. IPR laws have been created to protect your intellectual property from infringement.

Subscription businesses should safeguard their brand identity and intellectual property while sharing it on the internet. This reduces the risk of brand abuse, trademark infringement, or reputation damage.

If your subscription involves trademarks, copyrighted content, or patented technology, get the necessary licenses and permissions for future disputes.

5. Data Privacy and Cybersecurity Regulations

Adapting to the data privacy and cybersecurity regulations is not just security compliance — but winning trust and forging customer relationships! You cannot neglect these non-negotiable legal considerations for subscription business.

GDPR, CCPA, and Global Data Protection Laws

Consumer data is valuable and businesses can’t risk to underestimate its importance. While collecting essential data can help subscriptions to offer personalized services, consumers might be reluctant to give up their personal information.

Moreover, with increasing data protection regulations, collecting data has become all the more difficult. Let’s take a look at the major global data privacy laws and how they influence subscription businesses!

-

Global Data Protection Regulation (GDPR)

The GDPR law governs businesses established in the EU and entities providing services in the EU.

The law lays regulations for transparent data collection, data minimization, storage limitation, enhanced security measures, consumer rights awareness, among others.

-

California Consumer Privacy Act (CCPA)

One of the strictest laws in the US, CCPA, states how businesses should process customer data. Like GDPR, it’s applicable to both businesses operating in California and those providing services to individuals in California.

Its key regulations are clear disclosure of data collection, storage, usage and sharing in privacy policy and subscription forms. It expands consumers rights to access, opt-out, rectify, and even delete data. Additionally, it sets guidelines for the effective management of customer requests and data disposal.

Best Practices for Data Security

Compliance with GDPR and CCPA is challenging for subscription businesses, as they have to process data for customer billing cycles and customer retention.

Securing data is a prerequisite to ensure compliance with global data laws. Hence, subscription businesses must follow:

- Data Encryption – Use data encryption protocols like HTTPS for sensitive data like payment and billing information. Also, encrypt customer data stored on servers and databases to prevent unauthorized access.

- Access Controls – Allow access to your subscription platform based on role, thus reducing incidents of data breaches. Implement multi-factor authentication and a strong password policy for user accounts and internal systems. Grant “least privilege”, offering minimal access to users for completing their jobs.

- Security Audits – Conduct timely security assessments and testing to identify the potential weaknesses and vulnerabilities in your subscription system.

6. Handling Cancellations, Refunds, and Customer Disputes

Whether you’re setting up a subscription box for food services or live fitness classes, your ultimate goal is to satisfy your customers. Well, you can’t please everyone and customer disappointments are inevitable! To handle the cancellations and refunds, you need to plan well ahead!

Creating a Compliant Refund & Cancellation Policy

A fair and transparent refund policy & cancel is a must for managing any subscription business. It clearly defines when customers can raise a refund request. Even service-based subscription businesses get refund requests from dissatisfied customers.

Refund policies could be overwhelming, considering the amount of information to be included. Some of the essential elements to be included in the refund policy are:

- Eligibility to raise a refund request

- Timeframe for requesting a refund after purchase

- Steps to raise a refund request and proof required

- Whether the customer is eligible for returns, exchanges or refunds

- Refund exceptions where standard policy isn’t applicable

For the cancellation process, FTC’s recent “click-to-cancel” expects a simple cancellation process as its sign up. Similarly, the cancellation process must include eligibility, timeframe, process, and cancellation fees. This improves the overall customer satisfaction!

Preventing Subscription Fraud & Abuse

With the surge in subscription sales, incidents of fraud and counterfeits have also increased subsequently.

So, what’s a subscription fraud? A subscription fraud is a misleading or deceptive practice to gain unauthorized access into the subscription system. Fraudsters often exploit the subscription model using different tactics or methods.

This could be through account takeovers, payment frauds, chargeback frauds, service abuse, etc. This obviously leads to financial losses and compromises the system’s security.

Given below are different strategies to prevent fraudulent attacks:

- Transparent disclosure of subscription costs and terms of service

- Implement additional identity verification through SMS or email verification

- Monitor any unusual behaviour like multiple failed payments, excessive account creation attempts

- Limit account-sharing capabilities by limiting the number of devices that can access

7. International Expansion: Cross-Border Tax Implications

The tax obligations vary greatly across countries. Understanding the global tax implications is essential for tax compliance and better planning.

Here’s how tax compliance is different across the globe:

- United States: The US requires you to collect sales tax in states where the business has nexus (physical presence) or economic activity. Further, the complexity of sales tax differs from state to state.

- European Union: In the EU, businesses have to pay VAT on digital goods based on the consumer’s location. For physical goods, VAT depends on delivery location.

- Singapore: A 9% GST tax is applicable for all digital and non-digital services in Singapore.

- Regional Obligations: There is no single governing entity for sales tax in the US. You need to determine taxability based on state statute. Consider how the tax applies to sales of audio files, streaming services, and digital books.

Conclusion & Legal Best Practices

Understanding the legal considerations for subscription business is crucial to building customer trust and avoiding expensive lawsuits. Most importantly, you need fair and transparent terms and conditions, including subscription costs, cancellations, refunds, and auto-renewal clauses.

To comply with FTC’s click-to-cancel rule, ensure your subscription cancellation is straightforward. The tax implications for recurring subscriptions are different from one-time purchases. Check for sales threshold and tax obligations in your state and country.

With the surge in fraudulent chargebacks and data breaches, the legal bodies are planning to tighten the laws concerning subscriptions further. Prioritizing consumer consent, simplifying processes like cancellation, auto-renewal, and refund policies and making it more customer-centric.

Seeking legal advice is crucial for compliance and setting accurate systems to keep your subscription service up and running!

FAQ-Related to Legal Considerations for Subscription Business

1. What are the legal considerations for subscription business?

Given are the key legal considerations for starting a subscription business:

- Choosing the right business structure

- Transparent terms & conditions, including subscription pricing,auto-renewal clauses, cancellation policies & customer disputes

- Compliance with global laws & regulations

- Secure payment processing management & chargeback protection

- Tax management

- Compliance with data privacy & cybersecurity regulations

2. What are the major factors to consider when choosing a business structure for your subscription business?

When choosing a business structure, liability protection, tax implications, ease of operations, and business scalability should be considered. Your choice of subscription business depends on the type and size of your business. Each business structure has its own advantages and disadvantages, so choose based on your business needs.

3. Can businesses refuse to refund subscriptions?

Businesses can decline to refund subscriptions based on the state laws, cooling-off period, no refund policy, breach of contract, etc. Hence, subscription businesses should enforce a transparent cancel & refund policy stating the refund eligibility, timeframe, refund process, and refund exceptions.