Today, “the customer is king.” Hence, adopting a customer-centric approach is a survival instinct for businesses today. The inherent drive to stay competent motivates them to periodically track their success.

Subscription metrics are powerful tools in their success journey. These insightful metrics provide valuable insights on acquisition, retention, and revenue. Thus, you can continually gauge your business health and focus on long-term subscription growth.

But, which metrics should you track? We’ll cover all the essential metrics for your subscription business, what they indicate, and how to improve them.

So, let’s dive in!

Table of Contents

Why is it Important to Track KPIs for Your Subscription-Based Platform?

Like every business, subscription businesses have key performance indicators(KPIs) to track. These key metrics are commonly referred to as subscription metrics.

So, why is it essential to track KPIs? Primarily, because these metrics indicate the health of your subscription business. There are several metrics you can track for your subscription. Hence, your quest begins with finding the ones that matter the most!

When you track all the metrics, it is equivalent to getting lost in numbers. Instead, find the ones that align with your business goals.

Summing up, why you can’t miss tracking this data:

-

Track Business Performance

By keeping an eye on this data, you know where your business stands. For example, when your monthly revenue is higher, you know that it’s tough to retain your business for the long run!

You can set your goals and make appropriate tweaks to improve your business.

-

Insights on Customer Behaviour

Do customers love your subscription business? Look at the subscription trend. Analyze whether your monthly revenue is moving upwards or users are dropping off.

Thus, customer patterns = actionable insights. Then, you can go forth and refine your offering, utilize upselling opportunities, or reduce marketing spend.

-

Better Pricing Strategies

Your monthly revenue is a direct indicator of whether your current subscription model and prices are hitting the nail on the head. This way, you can experiment with different membership price points and models to see which gives maximum ROI.

-

Improve Marketing and Sales Strategies.

There’s no golden rule for selling subscription services. It’s a series of trials and errors.

Figure out which segments of the audience and marketing strategy yield results. The right subscription metrics help to refine your buyer persona. Thus, target the customers with the maximum potential.

-

Gauge Financial Health

If you are planning for a successful subscription, obviously, track the finances. From monthly recurring revenue to churn and customer lifetime value, these metrics capture how well your business fares.

7 Best KPIs to Track for Subscription-Based Platform

Below are the crucial metrics you shouldn’t ignore for a smooth subscription business:

1. Monthly Recurring Revenue

The first and probably the most important is monthly recurring revenue(MRR).

Your overall monthly revenue from all the subscriptions. For instance, you run a food subscription box. Look at your monthly subscription revenue to gauge its stability.

Further, it also showcases your revenue flow to accommodate expenses and measure long-term growth.

Along with MRR, look at a few other monthly numbers that matter. This could be new users, churn, upsells, or downsells.

Now, you calculate the revenue for each of the categories. This offers a more nuanced understanding. For instance, which segment is winning you maximum business, and which isn’t paying enough?

Formula:

MRR = Number of customers x Average Subscription Fee

If you have an annual revenue analysis,

MRR = Annual Recurring Revenue/ 12

How Does it Help?

- Forecast your business revenue

- Identify the churn risk

- Powerful performance indicator

- Indicates product-market fit

- Better budgeting and planning

Solution:

- Optimize your pricing and billing model

- Implement a tiered pricing model

- Introduce free trials and discounts

- Persuade your free users to a higher plan by upselling

- Switch to the annual billing option

2. Churn Rate

As businesses are moving from customer acquisition to retention, author Stephen Covey’s words ring true more . “The key is not in gauging the spending time, but how well invested it is.”

That’s why businesses, such as Saas, subscription boxes, and streaming platforms, are prioritizing retention. And churn rate is the best metric for tracking retention.

Churn is the rate at which people cancel your subscription within a specific period. This shows the value customers derive from your business.

If your subscription businesses are apt for customers, they are likely to stick with them. Thus, your churn rate is low. What does this mean? Customers love your product and find it quite engaging.

On the other hand, a higher churn indicates major product improvements or onboarding issues. When do you say the churn is too high? Anything above 5% monthly or 20% annually is concerning.

How Does it Help?:

- Avoid focussing on the wrong audience

- Loss of revenue

- Indicates customer satisfaction

- Underlying issues like poor customer experience, insufficient features, pricing challenges

- Business health and profitability

- Loopholes in the payment system

Solution:

- Improve your customer service

- Refine your product offerings

- Offer a flexible pricing plan

- Improve the onboarding workflow and personalize communication

- Loyalty programs include discounts, perks, exclusive content, etc.

Tip: Go beyond the customer numbers and look into the actual revenue churn. Delve deeper into the actual revenue lost from downgrades or cancellations.

3. Customer Acquisition Cost (CAC)

What’s a perfect marketing strategy like? It’s a delicate dance between an accurate marketing spend and actually winning customers. For that, you need to know the actual money required to acquire a customer. That’s what customer acquisition is all about!

Ideally, it is the total marketing and sales money to win and convert prospects into customers.

Formula:

Customer Acquisition Cost(CAC)= Total amount spent on customer acquisitionNumber of new customers acquired

Although not a direct subscription metric, it indicates whether your business model is viable. Typically, your customer acquisition cost should be less than customer lifetime value.

If your CAC is higher but the return is low, it indicates that acquiring customers is not profitable. That’s when you need to focus on retention.

You need to measure acquisition across different channels. For example, social media, email, Google Ads, SEO, etc.

How Does it Help?:

- Shows whether acquiring a new customer is profitable

- Shows overspending and underspending of resources

- Identify the most and least profitable marketing channels

- Indicates your business viability

- Analyzing effective resource allocation for channels

Solution:

To lower the customer acquisition cost:

- Track everything from ad spend, website visits, leads, etc.

- Determine the baseline to gauge your CAC

- Create specific landing pages, so you need to track only CTAs specific to that page

- Spot the channels with highest ROI and spend a higher budget on them

- Refine your marketing message and test different CTAs

4. Customer Lifetime Value

Customer Lifetime Value (LTV) is the average revenue expected from a single customer during their lifetime. Now, their relationship extends from signing up to the churn.

LTV is an essential metric, but is often neglected by businesses. It indicates a few things: CAC, churn, and average return per user.

When customers find expected value from your subscriptions, they won’t stay longer. And that means a higher LTV.

Now, let’s see how it’s calculated. There are a few ways to measure your Customer LTV.

Formula:

Subscriber Lifetime Value(LTV)=Average Revenue Per Subscriber x Gross Profit MarginChurn Rate

OR

Subscriber LTV = Average Transaction Size x Number of Transactions x Retention Period

However, here’s the kicker: Your LTV shouldn’t exceed the acquisition cost.

This answers the quintessential question: how much should I spend on acquiring and retaining customers?

If the sales and onboarding costs are more than the lifetime value, you need to reduce the unnecessary spend. Ideally, a LifetimeValue: CAC ratio of 3:1 is practical.

How Does it Help?:

A low lifetime value indicates:

- High churn

- Marketing overspend

- Low renewal rates

- A change in marketing strategy

A high lifetime value shows:

- A valuable customer segment

- A highly customer base

- Customers are deriving value from a product or service

- Increased revenue and profitability from the business

Solution:

- Improve your customer experience

- Personalize the onboarding experience, products, and services

- Create omnichannel presence

5. Annual Recurring Revenue

Is your subscription business measured annually? Then, you need to switch from MRR to ARR.

MRR offers the revenue statistics for a single month. Likewise, ARR captures the picture for the entire year. Thus, you get the groove of your business annually.

Here, you need to add up all the annual fees coming from every subscription throughout the year. This gives a deeper understanding of the annual trends of your business. Thus, this is insightful for setting long-term goals for your business.

Include MRR, account upgrades, downgrades, set-up fees, non-recurring add-ons, etc.

Formula:

ARR = Average Revenue Per User x Number of Users

OR

ARR = Monthly Recurring Revenue x 12 / Number of customers

How Does it Help?:

- Forecasting revenue

- Long-term planning

- A business’s financial health

- Customer satisfaction

- Upselling and cross-selling decisions

Solution:

- Improve customer success

- Reduce churn

- Offer annual plans

- Broaden your market reach

- Discounts on annual plans

6. Net Promoter Score (NPS)

Want to gauge the happiness quotient of your customers? Net Promoter Score (NPS) is a powerful way to gauge if your customers are satisfied enough.

In an age where word-of-mouth marketing still rings true. Gauging your customers’ tendency to recommend your subscription is crucial. Moreover, it gives insights into the willingness of customers to recommend your subscription service.

A score of 0-30 is a good NPS score, while anything higher than that is considered great.

While the customer satisfaction score provides a general sentiment of your brand, NPS offers a more nuanced insight into specific purchases and interactions.

You can collect NPS with emails, websites, or even within the product pop-ups. For example, your customer’s free trial just ended. Send an NPS survey capturing their views on their user experience.

Identify the key touchpoints and find when your customer is most engaged(first purchase, renewal, contract expiration). Grab this opportunity to collect the NPS score!

How Does it Help?

- Gauge the reason for customer loyalty and satisfaction

- Identify your promoters, detractors, and passives

- Identifying the reason for churn

- Identify areas for product improvement

- Track performance and benchmark

Solution:

- Collect customer feedback & identify patterns to improve them

- Improve customer service and resolve issues promptly

- Close the feedback loop and convert detractors into promoters

- Identify the root cause and fix the issue quickly

7. Average Revenue Per User(ARPU)

Another key metric that looks into the customer value is Average Revenue Per User. It demonstrates the average revenue from per subscriber. This is quite relevant for subscription businesses with an extensive customer base.

So, if your business doesn’t derive significant value from a customer, you shouldn’t limit your spending.

Formula:

Average Revenue Per User = Total Users / Total Number of Customers

For example, if the monthly revenue of your food subscription box is $10,000 from 100 subscribers.

Then, ARPU = 10000/100 = $100

i.e. $100 revenue per user

How Does it Help?

- Shows your valuable customers

- Helps strategic customer targeting

- Shows upselling and cross-selling opportunities

- Increase or minimize your marketing spend

- Insights on audience and pricing strategy

Solution:

- Balance the user acquisition and retention

- Check the pricing viability

- Encourage upsells and cross-sells

- Breakdown ARPU by different segments for more targeted insights

8. Trial Conversion Rate

The charm of free trials can’t be ignored if you are in the subscription business. First, the free trials attract customers. Once they find their “Aha moment”, they are likely to convert into an actual customer.

The percentage of free users that convert into paid subscribers after using the free trial.

Formula:

Trial Conversion Rate= Number of Paid Users Converted from Free TrialTotal Number of Trial Users x 100

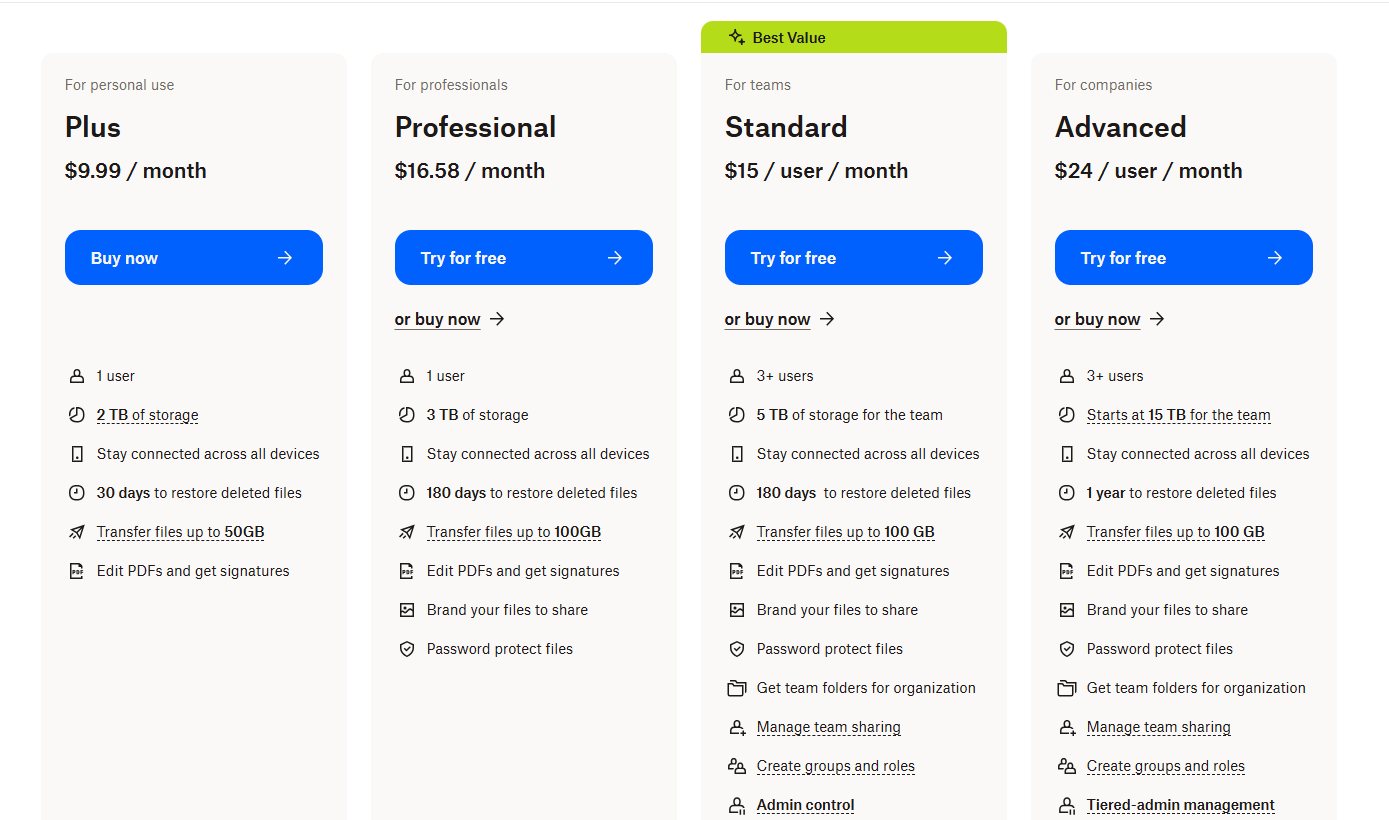

This metric is relevant, if you run a freemium business model.

Businesses implement the freemium model in two forms:

-

Premium Free Trial:

Users can avail of the free trial for a fixed period, where they explore the product. From the features to the user experience, they test if the subscription product is as expected. The only downside is that they have to give their payment details to avail of the free trial.

-

Basic Product:

There’s a basic free version of the product that new users opt for. Businesses restrict access by either offering limited features or placing caps on the users and features(e.g., 10 users per month). If their business needs to access the full features, they upgrade to the premium version.

Tip: Consider the cost incurred to provide the free trial against the profit gained once they get converted.

How Does it Help?:

- Determining product value

- CAC Optimization

- User engagement

- Predict revenue generation

Solution:

- Optimize your subscription features

- Refine your onboarding experience

- Provide strong customer support

- Highlight your product value

Conclusion

The subscription industry is competitive, with new players emerging every day. If you’re not scratching your head for innovation and novelty, you are bound to lose the race.

KPIs indicate how your subscription business is performing. It reflects the highs and lows of your business cycle. But identifying the right KPIs is all the more crucial. Indeed, this helps you to avoid hitting a flat note or faulty correlations.

So, which are the essential KPIs for your subscription business? We hope this guide helps you find the right metrics and some actionable insights to run your subscription business!

🏫 Related Blogs:

FAQ-Related to Best KPIs to Track for a Subscription-Based Platform

1. Which metrics are used to measure subscription revenue?

Monthly Recurring Revenue, Annual Recurring Revenue, Churn Rate, and Customer Acquisition Cost are the key subscription metrics to measure your subscription revenue.

2. What are the metrics to measure customer satisfaction?

Churn Rate, Net Promoter Score (NPS), Customer Satisfaction Score (CSAT), and Customer Lifetime Value (CLTV) are crucial metrics for measuring customer satisfaction.

3. What are the 5 most essential KPIs for a Saas business?

The five key metrics to measure KPI are:

- Monthly Recurring Revenue(MRR)

- Customer Acquisition Cost(CAC)

- Churn Rate

- Customer Lifetime Value (CLTV)

- Net Revenue Retention (NRR)